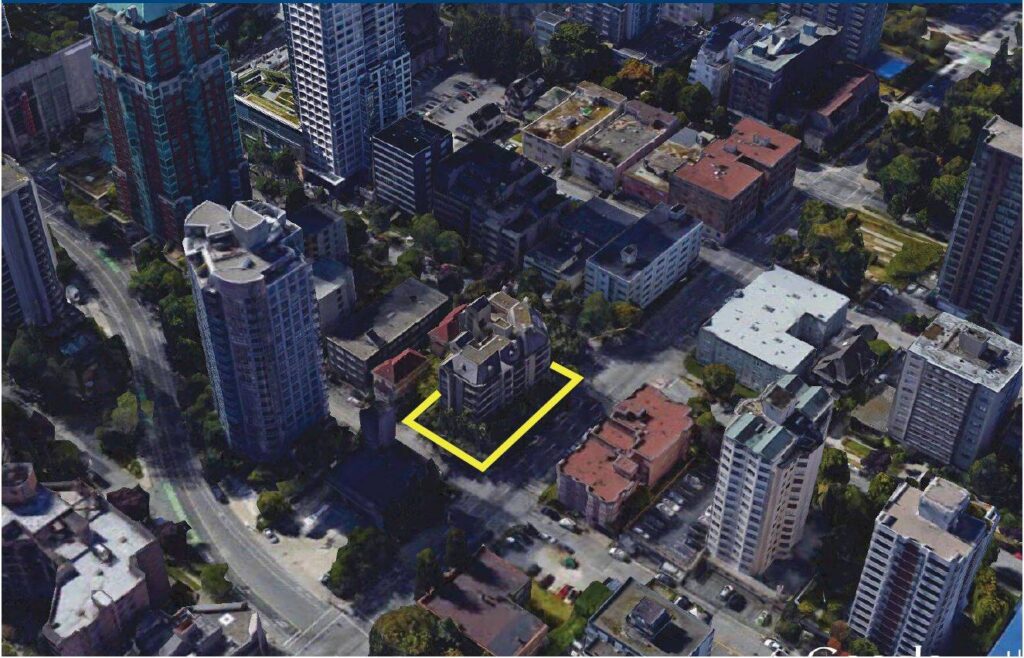

Due in part to the new West End Plan in Vancouver, the potential density of the building at 1075 Barclay Street, Vancouver BC had significantly increased. Now, instead of the current zoning allowing for a 90 foot (9 storey building), the potential rezoning of the building and adjacent lands could be 500 feet (50 stories), which is over a 5x increase in the valuation and investment opportunity. Before the building size could be increased to that degree, it required significant the investment decision of much needed repairs, so the owners decided to fund a $1,000,000 special assessment in the interim.

As is common in FSBO (For Sale By Owner) situations, some of the strata owners were taken advantage of by a few savvy developers who knew how much the potential return on this property could be. The developers purchased several units at above market but far below the redevelopment valuation, about 1/3 of the market price, under names of different companies and affiliates to stay discreet. By offering an additional cash bonus if the units sold in under 7 days, as well as not requiring real estate commissions, it appeared to many owners that the developers were offering a great deal, but there was more money for owners in a coordinated sale effort.

Once the Strata Council and building committee heard about the off-market sales that were happening, they conducted a thorough brokerage search and interview process. The building committee and ultimately the strata council selected Klein Group, Royal LePage Commercial to help protect their interests, subdue the efforts of the developers acquiring individual units, and proceed to maximize the value of the remaining 85% of units for highest and best price. Our land redevelopment and strata wind up team was up for the challenge. With a strong foundation in place for our go-forward strategy, we engaged critical resources in legal, architecture and planning to help provide the necessary insights and professional advice for owners get the sale back on track.

After Klein Group’s thorough and well-delivered proposal was reviewed by the Strata Council, amongst the proposals of six other national commercial brokerages, the Strata Council selected our team to turn the situation around. We wasted no time, immediately springing to action with a coordinated strategy aiming to:

Once our internal team was assembled, we engaged the law firm of Hakimi and Ridgedale LLP to create a legal framework that would discourage developers from purchasing single units in a strata without bidding on the entire property. Their air-tight framework was successful, and the individual purchases ceased at 18%. Thanks to the fast action of our firms working together, the sales stopped just before the 20% threshold. If 20% of the building had been purchased successfully, there would have been a blocking position for the developers under the Bill 40 strata legislation, leading to a massive decrease in value for our clients and the remaining strata units.

We also asked Stantec, our architectural partners, to provide an extensive and precise review of the site and its buildable size, along with a shadow analysis and view cones. This helped ensure that the 1075 Barclay Street owners did not leave any additional density on the table.

Aligning the owners’ best interests is a critical factor in ensuring everyone gets the best deal possible. By working to develop a unified front with all parties involved in the sale, we were able to keep potential developers engaged, serious, and competitive during the bid process. When executed correctly, professional representation will add far more value than it costs.

In the end, the Klein Group marketing package was sent to well over 250 development firm locally and internationally with 25 different developers expressing serious interest, with many of the packages and redevelopment details presented in person. From there, 13 developers submitted offers or written interest, and 3 of those developers advanced to a competitive bidding round with multiple bids. This process brought about a record sale price for a West End development site. All the units that were represented by Klein Group sold for top market value prices, while the owners who sold prior to representation left very large, six-figure sums of after-tax money on the table. This case illustrates how powerful top-notch representation is critical to land redevelopment, strata assembly and the Bill 40 strata wind up process in commercial real estate brokerage.